The Australian housing market has been a subject of intense scrutiny and debate over the past decade. With skyrocketing property prices, burgeoning inflation, and a complex mortgage environment, potential homeowners are constantly seeking innovative solutions to borrow during these financial challenges. The concept of crypto-backed mortgages, particularly using Bitcoin as collateral, is now in the conversation.

A Snapshot Of The Australian Housing Market

The Australian housing market has experienced unprecedented growth over the last few years. According to CoreLogic, the national median house price surged by 22.4% in 2021 alone, marking one of the most significant annual increases in history . Sydney and Melbourne, the two largest cities, have seen median house prices climb to $1.1 million and $806,000, respectively . This rapid appreciation in property values has made homeownership increasingly challenging for many Australians, particularly first-time buyers.

In tandem with rising property prices, Australia has also grappled with inflationary pressures. As of April 2024, the inflation rate stood at 3.6%, driven by higher costs of living, energy prices, and supply chain disruptions. This inflationary environment has further strained household budgets, complicating the path to homeownership.

Cryptocurrencies As An Emerging Asset Class

Cryptocurrencies, particularly Bitcoin, have transitioned from niche digital assets to mainstream financial instruments over the past decade. Bitcoin, the pioneer of the cryptocurrency market, has garnered significant attention due to its decentralised nature, limited supply, and potential as a hedge against inflation. As of mid-2024, Bitcoin's market capitalisation hovers around $2.3T USD, cementing its status as a significant player in the global financial ecosystem.

In Australia, the acceptance of cryptocurrencies has been steadily increasing. A survey by Swyftx in 2023 revealed that approximately 32.4%% of Australians owned some form of cryptocurrency, with Bitcoin being the most popular choice . This growing acceptance has paved the way for innovative financial products, including crypto-backed loans and, more recently, the concept of crypto-backed mortgages.

The Conversation of Crypto-Backed Mortgages

Crypto-backed mortgages represent a novel intersection of traditional finance and digital assets. These financial products allow borrowers to use their cryptocurrency holdings, as collateral to secure a mortgage. The mechanics are relatively straightforward: a borrower pledges their Bitcoin to a lender, who in turn provides a mortgage loan based on the value of the cryptocurrency.

This arrangement offers several key considerations:

- Access to Liquidity Without Selling Assets

Borrowers can access the liquidity needed for a home purchase without having to sell their Bitcoin holdings. This is particularly advantageous in a bullish market where the asset's value is expected to appreciate. - Diversification of Collateral

By using Bitcoin as collateral, borrowers can diversify their asset base, potentially reducing the risk associated with traditional real estate investments. - Faster and More Efficient Process

The approval and funding process for crypto-backed mortgages can be faster than traditional mortgages due to the streamlined evaluation of digital assets and fewer regulatory requirements.

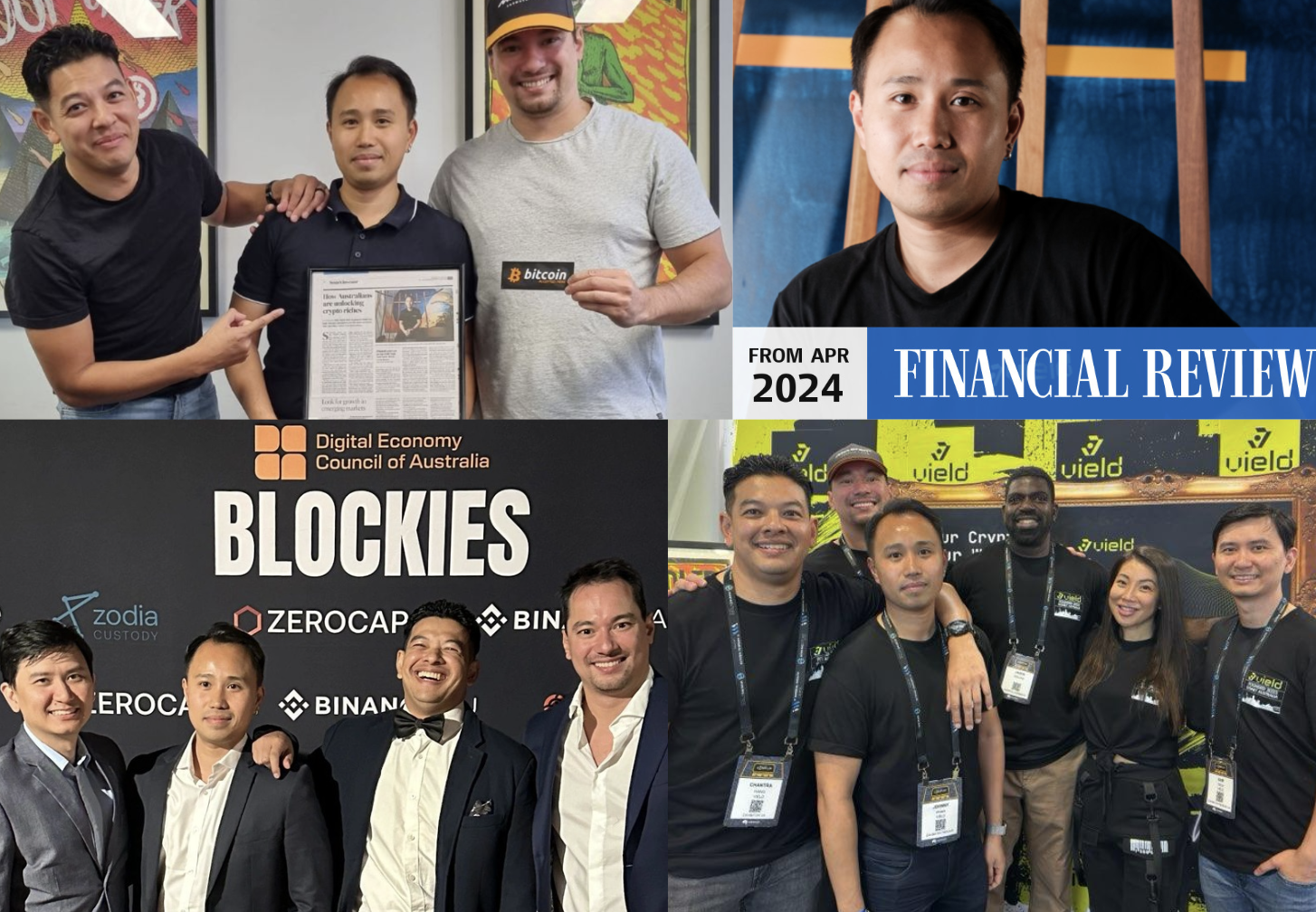

"Crypto-backed mortgages represent a transformative approach to home financing," says Sam Teoh, the CFO of Vield." We've seen a growing number of borrowers leveraging their cryptocurrency assets, particularly Bitcoin, to secure loans for purchasing homes. This innovative solution not only allows them to retain ownership of their digital assets but also provides them with the liquidity needed to enter the housing market. It's a positive situation that aligns well with the increasing acceptance of cryptocurrencies as a viable asset class."

The Risks and Opportunities

While the concept of crypto-backed mortgages is compelling, it is essential to acknowledge the associated risks. The most significant risk is the volatility of cryptocurrencies. Bitcoin, for example, has experienced dramatic price swings, which could impact the collateral value and, consequently, the terms of the mortgage. Lenders may require additional collateral or enforce margin calls if the value of Bitcoin falls significantly, adding a layer of complexity to the mortgage agreement.

Despite these risks, the potential for crypto-backed mortgages in Australia is significant. As the cryptocurrency market matures and regulatory frameworks become more substantial, these financial products could offer a viable alternative to traditional mortgages, particularly for tech-savvy and financially astute borrowers.

The intersection of cryptocurrencies and traditional finance is creating new opportunities in the Australian housing market. Crypto-backed mortgages, leveraging the value of assets like Bitcoin, represent a novel considered solution to the challenges posed by rising property prices and inflation. While this market is still in its infancy, the potential for growth and adoption is substantial. With careful consideration and prudent risk management, these financial products could become a considered solution of the Australian housing finance system, offering a new pathway to homeownership in an increasingly digital world.

For a tailored consultation, please reach out to our team.

Related Post

.png)