One of the most innovative changes in the past year has been the introduction of Ethereum-backed loans to Australia. As Ethereum and other cryptocurrencies gain mainstream acceptance, they are increasingly being utilised as collateral for loans, offering a modern, flexible solution for both individuals and businesses.

Evolution of Collateral in Financial Lending

Traditionally, collateral for loans consisted of tangible assets such as real estate, vehicles, and other physical properties. These assets provided a safety net for lenders, ensuring that if the borrower defaulted, there was something of value to recover. Over time, the types of assets accepted as collateral have expanded to include stocks, bonds, and other financial instruments.

The boom of cryptocurrencies has introduced a new class of digital assets. Ethereum, launched in 2015, has become one of the most prominent cryptocurrencies, second only to Bitcoin in market capitalisation. Its decentralised nature, smart contract capabilities, and growing acceptance have positioned it as a significant asset class in the financial industry.

Ethereum as a Growing Asset

Ethereum's journey from a novel digital currency to a widely recognised asset has been remarkable. Its blockchain technology, which supports smart contracts, has found applications in various industries, further solidifying its value. As more people and institutions adopt Ethereum, its value has increased, making it an attractive option for collateral.

The volatility of Ethereum, similar to other cryptocurrencies, is seen as both a risk and an opportunity. While the price can fluctuate, the overall trend has been one of significant growth. This potential for appreciation, combined with its liquidity, makes Ethereum an appealing choice for securing loans.

How Vield Facilitates Ethereum-Backed Loans

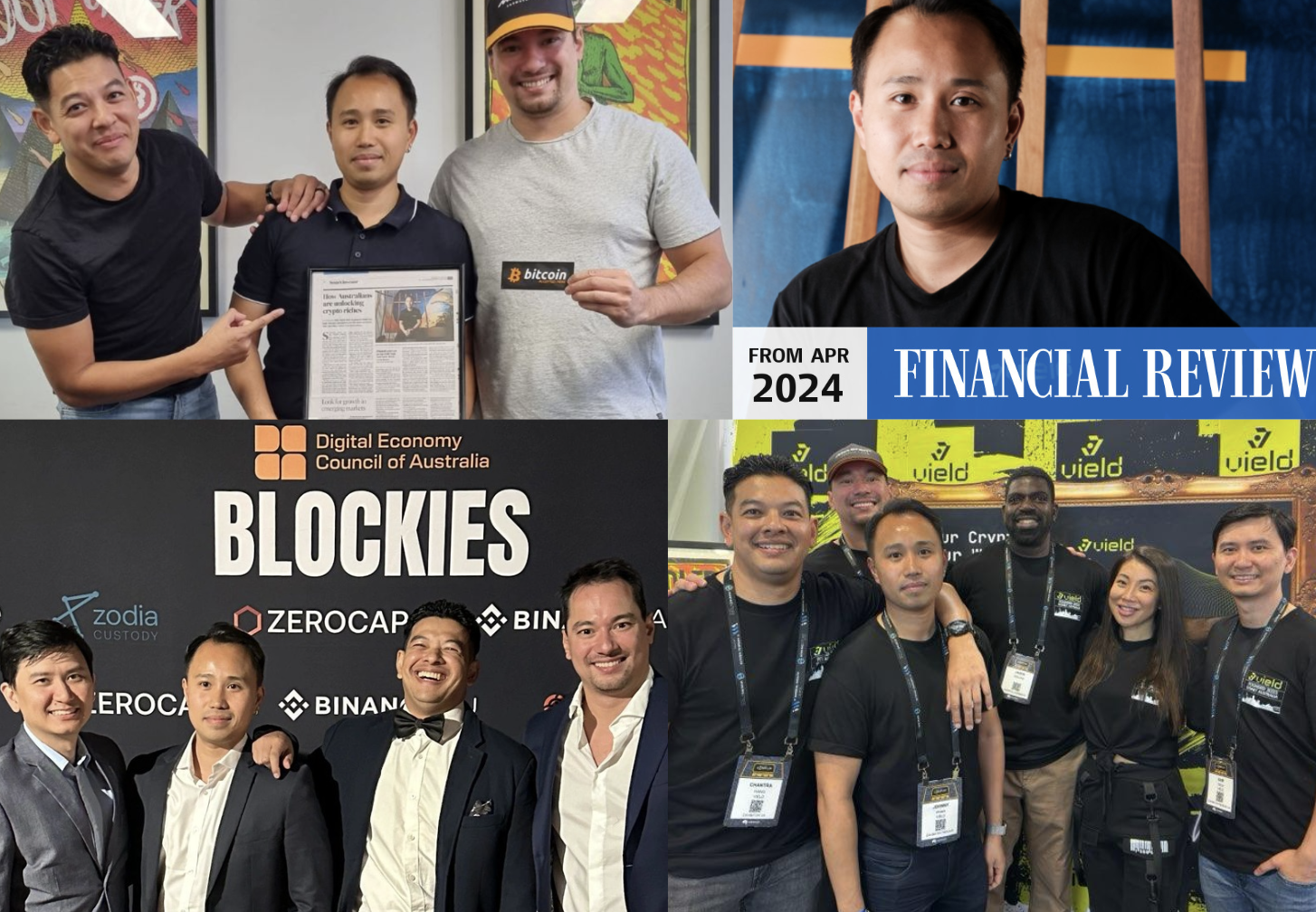

Vield is at the forefront of the crypto-backed loan industry, providing innovative solutions for those looking to leverage their Ethereum holdings. Our platform allows users to obtain loans using Ethereum as collateral, offering a flexible and efficient alternative to traditional lending.

At Vield, we understand that financial needs can vary widely. Whether you're looking to consolidate debt, fund your business, or meet other financial obligations, our Ethereum-backed loans can provide the funds you need without the lengthy approval processes associated with conventional loans.

Example Scenario 1: Debt Consolidation

Consider a scenario where a client uses their Ethereum to secure a loan for debt consolidation. As of today on May 23 2024, the price of Ethereum is AUD 5,600. Our client holds 50 ETH, amounting to a total value of AUD 280,000.

At Vield, we offer loans with a Loan-to-Value Ratio (LVR) of up to 50%. This means our client can borrow up to 50% of the value of their Ethereum holdings. In this case, the maximum loan amount would be AUD 140,000.

Loan Details:

- Collateral: 50 ETH

- Value of Collateral: AUD 280,000

- LVR: 50%

- Loan Amount: AUD 140,000

With this loan, the client can consolidate their debts into a single, manageable payment. The Ethereum remains in a secure escrow account, and once the loan is repaid, the Ethereum is released back to the client. This approach allows the client to leverage their digital assets while retaining ownership of the Ethereum, benefiting from any potential future appreciation.

Example Scenario 2: Business Funding

In another scenario, let's explore how a crypto-backed loan can be used for business funding. Suppose an entrepreneur needs AUD $100,000 to expand their business and holds 40 ETH valued at AUD $224,000.

Using Vield's services, the entrepreneur can secure a loan to fund their business expansion. With a 50% LVR, the loan amount would be AUD 112,000, which is more than sufficient for the required business funding.

Loan Details:

- Collateral: 40 ETH

- Value of Collateral: AUD $224,000

- LVR: 50%

- Loan Amount: AUD $112,000

This arrangement allows the entrepreneur to access the necessary funds without liquidating their Ethereum holdings. By keeping Ethereum as collateral, the entrepreneur retains the potential for future gains as the value of Ethereum appreciates.

The Benefits of Ethereum-Backed Loans

Ethereum-backed loans offer several advantages over traditional lending options. These benefits include:

- Speed and Efficiency

The approval process for crypto-backed loans is typically faster than that for traditional loans. This is because the collateral is digital and easily verifiable, eliminating the need for extensive paperwork and credit checks. - Flexibility

Borrowers can use the loan for a variety of purposes, from debt consolidation to business funding. The terms of the loan can also be tailored to meet the specific needs of the borrower. - Retention of Asset Ownership and Unlock Cash Flow

Borrowers retain ownership of their Ethereum while using it as collateral. This means they can benefit from any increase in the value of Ethereum over time. - Lower Interest Rates

Due to the security provided by the Ethereum collateral, lenders can offer lower interest rates compared to unsecured loans or credit cards.

Understanding the Risks

While Ethereum-backed loans offer numerous benefits, it's essential to be aware of the associated risks. The primary risk is the volatility of Ethereum. A significant drop in the price of Ethereum could result in a margin call, where the borrower must provide additional collateral or repay part of the loan to maintain the agreed LVR.

To mitigate this risk, Vield implements stringent risk management protocols. We continuously monitor the value of the collateral and provide timely notifications to borrowers if the value approaches the threshold for a margin call. This proactive approach ensures that both the lender's and the borrower's interests are protected.

Ethereum-backed loans represent a significant advancement in the lending industry, providing a bridge between traditional lending and the crypto revolution. At Vield, we are committed to offering secure, flexible, and efficient loan solutions that leverage the growing value of Ethereum.

Whether you're looking to consolidate debt, fund your business, or explore other financial opportunities, our crypto loans in Australia provide a viable and attractive option. By using Ethereum as collateral, you can unlock the value of your Ethereum without selling them, allowing you to benefit from their potential future appreciation.

.png)