Cryptocurrency has transformed the way we think about money, offering new possibilities for transactions and investments. One of the key players in this ecosystem is Tether (USDT), a stablecoin pegged to the US dollar. As its popularity grows, so does the need for more sophisticated ways to trade it. At Vield, Over-the-Counter (OTC) trading is one of our core services for those seeking large-volume USDT trades with no slippage and quick settlement.

What Is OTC USDT Trading?

Over-the-Counter (OTC) trading involve trading assets directly between two parties, outside of traditional exchanges. In the case of USDT, OTC trading allows buyers and sellers to trade substantial amounts of this stablecoin without going through public exchanges. Unlike standard exchanges, which display prices to all users and may suffer from liquidity issues or price slippage, OTC trading offer a more personalised and controlled trading environment.

Why OTC USDT Tranding Are Needed

OTC trading have become essential for several reasons:

- Large-Scale Trades

When trading large amounts of USDT, doing so on a public exchange can lead to significant price fluctuations and slippage. OTC trading enables large trades to be executed at agreed-upon prices without impacting the broader market. - Discretion

Privacy is a major concern for many traders, especially those dealing in substantial sums. OTC trading allows participants to maintain a higher level of anonymity compared to public exchanges, where trades are visible to everyone. - Speed and Efficiency

For those needing to move large amounts of USDT quickly, OTC trading offers a faster alternative to the sometimes slow and cumbersome process of public exchange trading. - Customisation

Every OTC trade is negotiated between the buyer and seller, allowing for customised terms that suit both parties. This flexibility is often not available on traditional exchanges.

How OTC USDT Trading Work

Understanding the mechanics of OTC USDT trading is key to appreciating their value.

- Finding a Counterparty

The first step in any OTC trade is finding a willing counterparty—someone who wants to buy or sell USDT in the desired amount. This is often facilitated by brokers or platforms like Vield that specialise in OTC trading. - Negotiation

Once a counterparty is found, the terms of the trade are negotiated. This includes the price, the amount of USDT to be traded, the payment method, and any other relevant conditions. Unlike public exchanges where prices are set by market forces, OTC prices are agreed upon by the two parties. - Execution

After terms are agreed upon, the trade is executed. This can involve a direct transfer of USDT between wallets, or through an escrow service to ensure both parties fulfil their obligations. - Settlement

The final step is settlement, where the agreed-upon fiat currency or other assets are exchanged for the USDT. This step varies depending on the payment method and the agreement between the parties.

Benefits of OTC USDT Trading

OTC USDT trading offers a range of benefits that make them an attractive option for many traders.

- No Price Slippage

Price slippage occurs when large trades move the market price of an asset. In a public exchange, placing a large buy or sell order can cause the price to move unfavourably before the order is fully executed. OTC trade mitigates this by agreeing on a fixed price beforehand, regardless of the trade size. - Enhanced Privacy

In an age where privacy is increasingly important, OTC trades provide a level of discretion that is unmatched by public exchanges. The details of the trade, including the identities of the participants, are kept private, which is particularly valuable for high-net-worth individuals and institutions. - Personalised Service

OTC trading is often facilitated by brokers who provide a personalised service, guiding participants through the process and ensuring that the trade is executed smoothly. This level of service is particularly beneficial for those new to large-scale crypto trading. - Access to Liquidity

For those needing to buy or sell large amounts of USDT, liquidity can be a challenge on public exchanges. OTC desks typically have access to a broader pool of liquidity, making it easier to execute large trades without delay. - Customised Terms

Public exchanges operate on a take-it-or-leave-it basis, with little room for negotiation. OTC trading, on the other hand, allow for the terms of the trade to be customised to the needs of both parties. This can include specific settlement dates, payment methods, and even the inclusion of legal agreements to provide additional security.

Who Uses OTC USDT Trading?

OTC USDT trading is used by a wide range of participants, from individual traders to large institutions.

- Institutional Investors

Banks, hedge funds, and other financial institutions often use OTC trading to enter or exit large positions in USDT without affecting the market. The privacy and customisation offered by OTC trades are particularly appealing to these entities. - High-Net-Worth Individuals

Individuals looking to trade large amounts of USDT for investment or other purposes often prefer the discretion and personalised service of OTC trading. - Crypto Funds

Funds that manage large portfolios of cryptocurrency assets use OTC trading to manage their USDT holdings. This allows them to execute trades without revealing their strategies to the market. - Businesses

Companies that accept USDT as payment or use it for cross-border transactions may use OTC trading to manage their USDT reserves. - Crypto Miners

Miners who receive large amounts of cryptocurrency as rewards for their work may use OTC trading to convert their holdings into USDT, particularly if they need to do so without impacting the market price.

How to Get Started with OTC USDT Trading

If you're considering OTC USDT trading, here’s how you can get started.

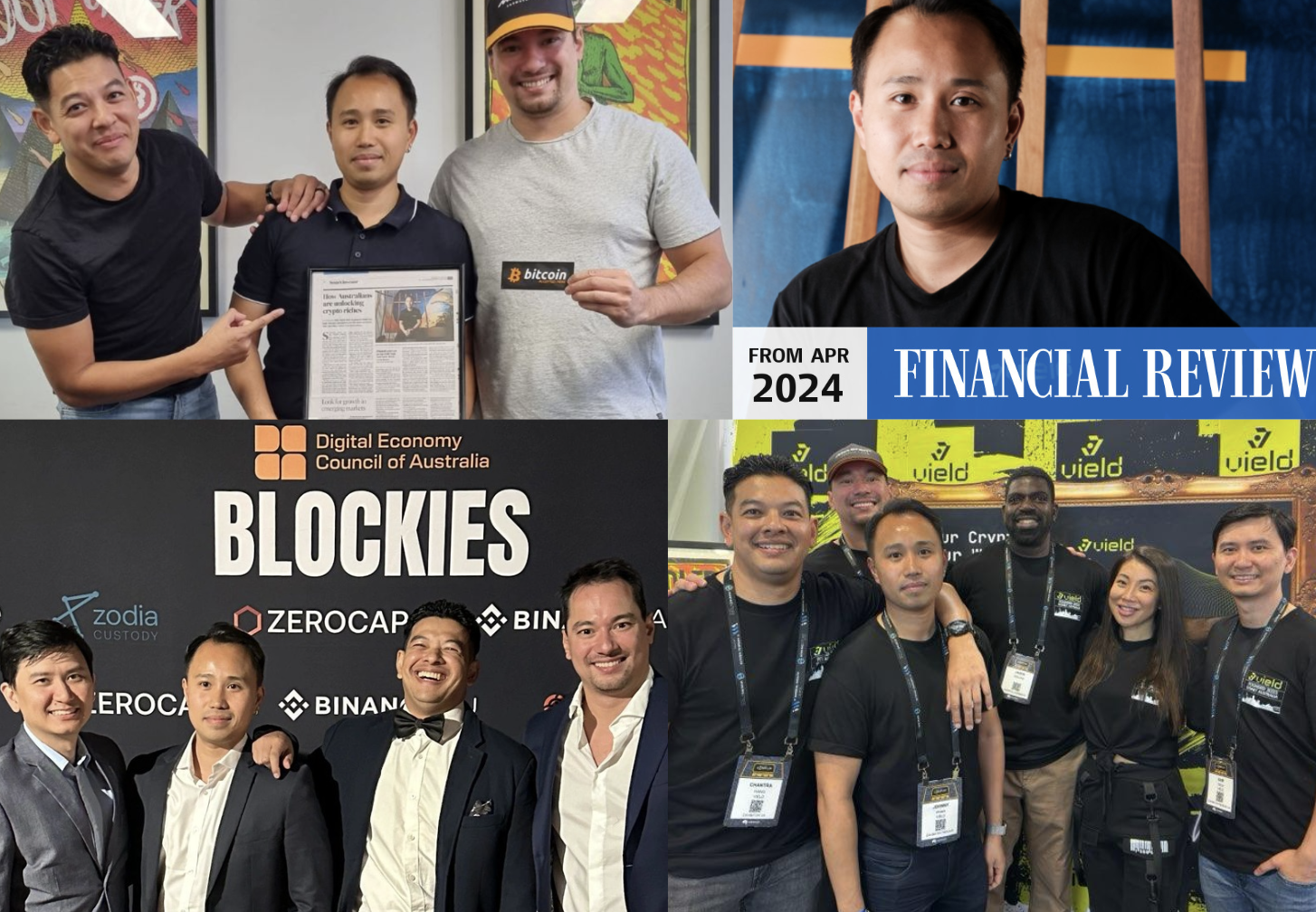

- Choose a Reputable OTC Desk: the Vield team!

The first step is finding a reliable OTC desk or broker. Look for a provider with a solid reputation, a transparent fee structure, and a strong track record. At Vield, Johnny, Alex, and Sam can help you with your OTC USDT trade. - Know Your Limits

OTC trading typically involves large sums of money, so it’s important to understand your financial limits and risk tolerance before engaging in a trade. - Understand the Process

Familiarise yourself with the OTC trading process, including how to negotiate terms, execute trades, and settle transactions. This will help you feel more confident and prepared when you enter the market. - Secure Your Assets

Ensure that your USDT and any fiat currencies involved in the transaction are securely stored. Use reputable wallets and payment methods to reduce the risk of fraud or loss. - Monitor the Market

Keep an eye on market conditions, even if you’re trading OTC. Understanding the broader market can help you make informed decisions and negotiate better terms.

Risks and Considerations

While OTC USDT tranding offer many advantages, they also come with certain risks.

- Regulatory Concerns

Cryptocurrency regulations vary by country, and engaging in OTC trading may involve navigating complex legal landscapes. Make sure you understand the regulatory environment in your jurisdiction before participating in OTC trades. - Market Volatility

Although OTC trades can protect against price slippage, the broader market can still impact the value of USDT and other cryptocurrencies. Be mindful of market volatility and how it might affect your transaction. - Bank Account

High-volume transactions can trigger scrutiny from banks due to anti-money laundering regulations, leading to potential account freezes or closures. Be aware of your bank’s policies to avoid disruptions.

Conclusion

Over-the-Counter (OTC) USDT trading are an essential tool for those looking to trade large amounts of crypto without the constraints of public exchanges. They offer a range of benefits, including no price slippage, enhanced privacy, personalised service, and access to greater liquidity. However, like any financial service, they come with risks that must be carefully managed.

For those interested in exploring OTC USDT trading, platforms like Vield provide a reliable and professional service tailored to your needs. By understanding the process and taking the necessary precautions, you can confidently navigate the world of OTC trading and make the most of the opportunities it offers

.png)